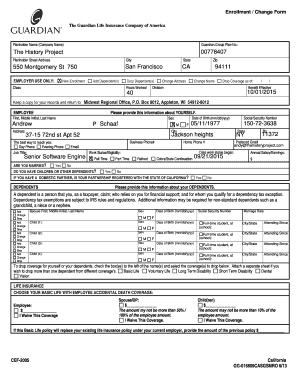

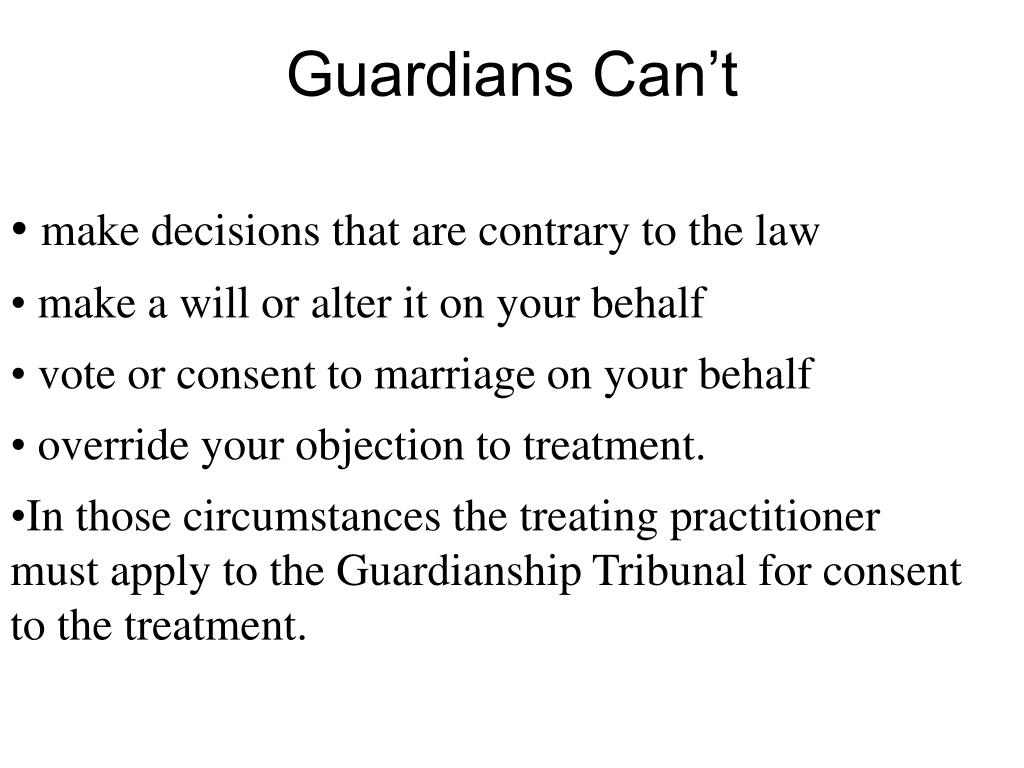

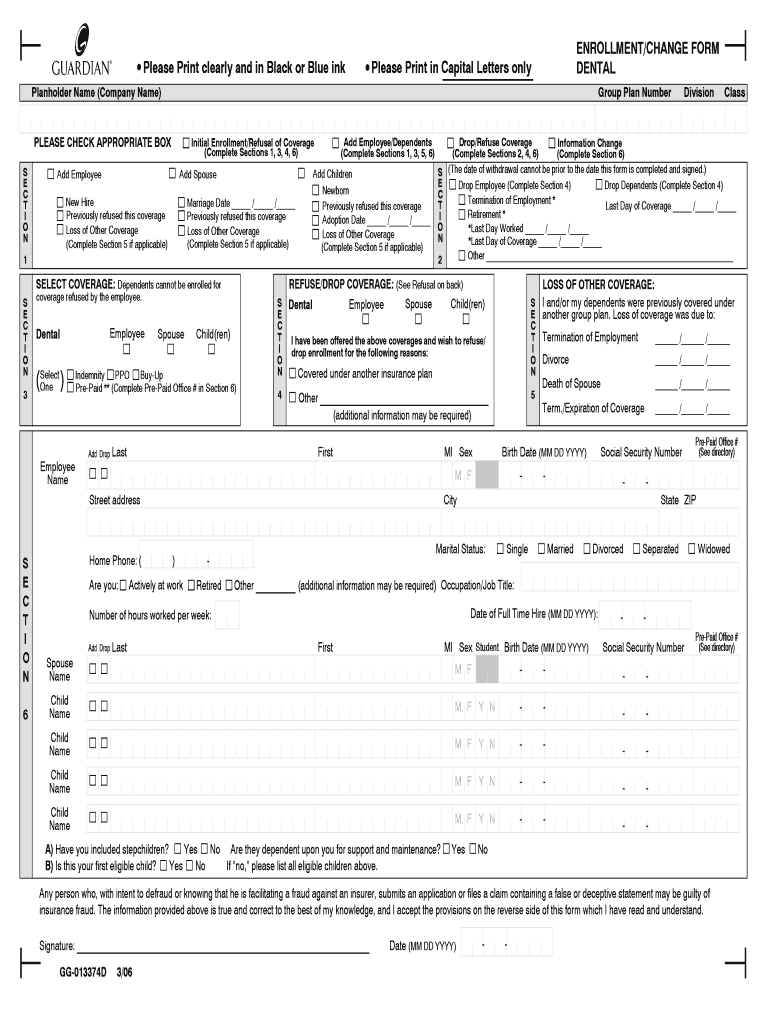

When you leave life insurance money to someone for the benefit of your kids, remember that person can spend the money. Life Insurance Intended for Kids Not Trustee (96): A trustee will be authorized to make financial decisions with the money intended for your kids. In some instances, guardians also physically neglected and abused their victims Given these statistics, it is important to ensure that systems designed to protect seniors from abuse and neglect function properly. In 20 selected closed cases, GAO found that guardians stole or otherwise improperly obtained $5.4 million in assets from 158 incapacitated victims, many of whom were seniors. Compared to the general population, adults over the age of 65 are more likely to live alone than those of younger ages. As citizens age, they may become physically or mentally incapable of making or communicating important decisions for themselves, such as those required to handle finances or secure their possessions. Census Bureau (97): by the year 2025, number of Americans aged 65 and older will increase by 60%. Often this is to ensure you have best surrogate parent and to ensure the money you provide for your children actually benefits your children and are not spent on things and people who have no right to the use of the money. Guardianship for Your Children (98): Some parents name one person as children's personal guardian and a different person to look after financial matters. However, in order to have this as an option, the trust must be in existence before the insured person dies and the trust must be specifically designated as a beneficiary on the life insurance policy's beneficiary designation statement. It is not unusual for such a trust to manage the funds until the child reaches age twenty-five or even older. The duration of the trust can be to whatever age you believe would be appropriate for the child which can be well beyond the child's eighteenth birthday. During the time that the proceeds are held in the trust, a trustee can be given the ability to expend principal and income from the trust for the benefit of the minor child.

#DIFFERENCE BETWEEN GUARDIAN LIFE AND GUARDIAN ANYTIME FULL#

A trust can be tailored to specific criteria & desires as to when you would want the child to have full access to the life insurance proceeds. People may leave their life insurance proceeds to a trust for the benefit of the minor child. Life Insurance Proceeds Left to Minor Child (99): When a minor child is a beneficiary of a life insurance policy, the money is managed on behalf of the child by the child's guardian or parent until the child reaches a certain age at which time any remaining funds must be turned over to the child.

This is for general discussion only not intended as legal or specific financial advice.

The principle behind guardianship and conservatorship is noble, but how do you ensure your money and resources benefit your kids. This can help provide best surrogate parent as well as to ensure the money you provide for your children actually benefits your children and are NOT spent on things and people who have no right to the use of the money. How can parents ensure that the designated Guardian or Custodian manages life insurance funds and resources are managed in the best interest of a child and not the best interest of the custodian or custodian's own family or self? Guardians & Custodians may have a fiduciary responsibility to manage the funds in the child's interest, but what happens when the guardian or custodian's own personal situation or that of others creates a demand for the life insurance money intended for the care and education of your children? What happens if Guardian or Custodian decides to spend the money of a new car or new home for themselves or others instead of your children who will seek restitution of your children? To ensure the best interest of your children dictate use of life insurance or other estate resources, some parents name one person as children's personal guardian and a different person to look after financial matters.

0 kommentar(er)

0 kommentar(er)